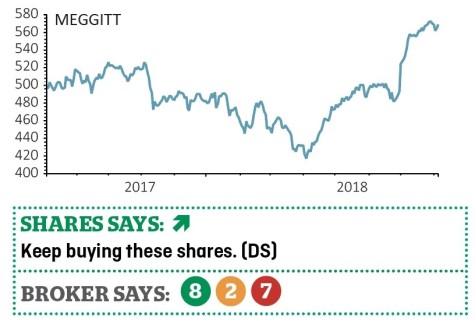

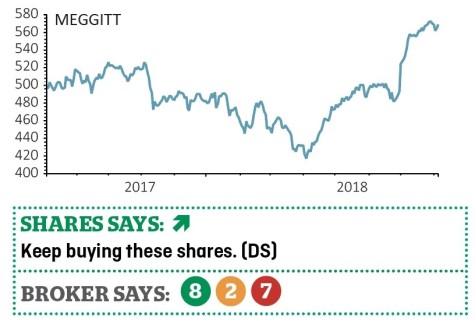

MEGGITT

(MGGT) 568.2p

Gain to date: 13.4%

Our enthusiasm for this company has paid off and with its half year to 30 June results released on 7 August, it seems an appropriate time to have another look at aerospace and defence company Meggitt (MGGT).

One of the things we liked about the business was the amount of big contracts it had secured. Interim results show that the company’s orders had grown organically by 24% to £1.1bn with revenue increasing 9% to £952.2m, both on a year-on-year basis.

The revenue growth was driven by strong trading in the civil aftermarket and military. Significantly the company’s free cash flow was £16.1m higher than market forecasts, coming in at £27.1m.

The share price was lifted by the company increasing its full year revenue growth guidance from 4% to 6% in July.

One disappointment is the full year operating margin being forecast to be at the bottom end of the 17.7% to 18% range.

Sandy Morris, analyst at investment bank Jefferies, says ‘We still regard the Meggitt equity story as long term in nature, but after a torrid patch it is good to see the story gain momentum’.

‹ Previous2018-08-09Next ›

magazine

magazine