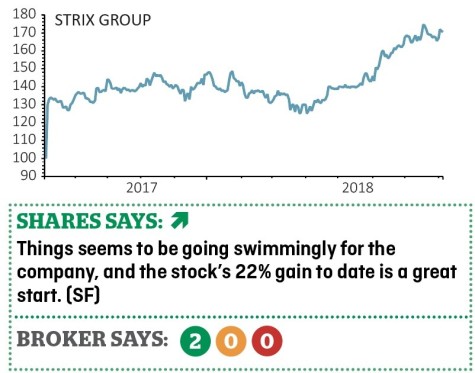

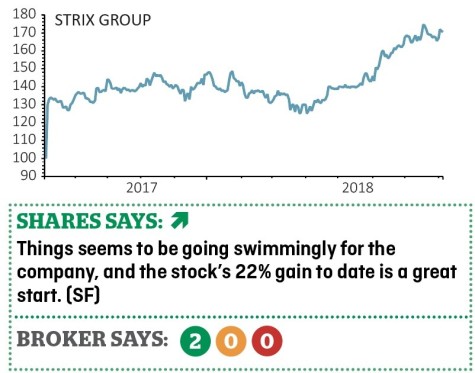

STRIX

Gain to date: 22.3%

Kettle controls company Strix (KETL:AIM) seems to be ticking along nicely judging by last month’s trading update (18 July).

The announcement struck a confident tone on performance that effectively confirmed that it remains on track to meet full year 2018 expectations.

That implies about £29.2m of pre-tax profit on something close to £96m to £96.5m of sales.

Cash conversion continues to be very strong which should make investors feel that bit more comfortable about dividends this year, not that there has been any real doubt about the anticipated 7p per share payout.

Perhaps the standout information was on its relatively new U9-Series product, its lower cost line largely aimed at penetrating less regulated end-markets overseas, particularly China. Securing around 1m units for delivery across various specifications versions is a cracking start.

A note about successfully fighting off IP infringement in China and elsewhere also shows that the company is capable of battling its corner and not being bullied by bigger electronics suppliers.

Light on financial data, we’ll get more detail at half year results on 9 September.

‹ Previous2018-08-09Next ›

magazine

magazine