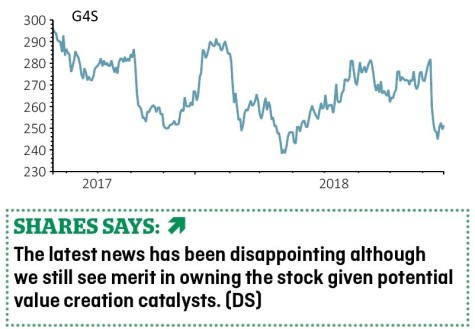

G4S (GFS) 251p

Loss to date: 2%

Security services company G4S (GFS) has had a torrid time in recent weeks. The Government has assumed control of Birmingham Prison from the company after a report revealing major widespread failings.

Prison inspectors said the prison had fallen into a ‘state of crisis’, with the chief inspector of prisons, Peter Clark, describing it as the worse prison he had ever seen.

This followed results released on 9 August which showed a company whose pre-tax profit had declined by 3.2% to £212m while operating cash flow fell 2.2% to £179m on a year-on-year basis.

However, we still remain positive on the company as it can sell off its Cash Solutions business which would plug its pension deficit and give the company more options.

Kean Marden, analyst at investment bank Jefferies, says selling the business would lead to around £2bn in surplus capital to ‘deploy on technology acquisitions’.

Jefferies is not the only voice that sees the potential for G4S from making disposals; fellow investment bank UBS has been saying this for some time. Back in January it was suggesting that the company could either dispose of its Cash Solutions business or alternatively demerge it and list it separately.

The shares trade on 11.3 times 2019 forecast earnings per share of 22.24p.

‹ Previous2018-08-23Next ›

magazine

magazine