Many stock market-listed corporate brokers are under pressure thanks to new regulation called MiFID II which is affecting demand for their equity research.

Before the new regime, brokers could pack their company research into the whole offering they provide to what’s called the ‘buy side’, typically represented by asset managers. Now brokers must ‘unbundle’ this research and charge clients separately for it.

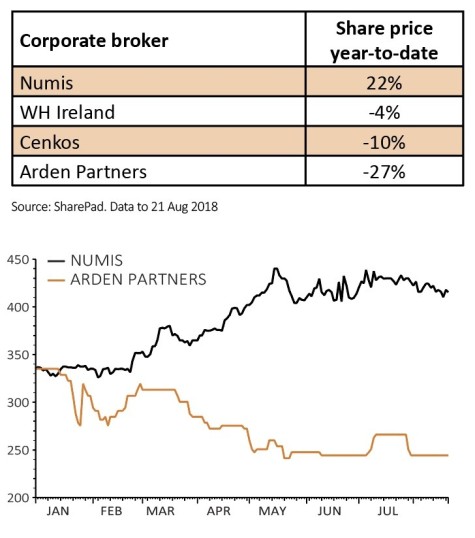

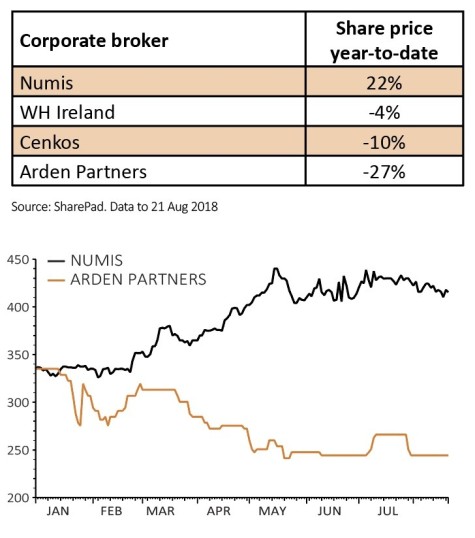

This may not be a problem for some of the large investment banks as they have multiple revenue streams. For smaller brokerages such as Arden Partners (ARDN:AIM), the impact seems apparent in its results. It suffered a £2.3m pre-tax loss for the six months to 30 April 2018 and its share price has declined by 27% year-to-date.

Not all brokers are struggling. Numis (NUM:AIM) grew pre-tax profit by 86% to £19.5m in the six months to 31 March 2018 and its share price has increased by 22% year-to-date.

Data from fintech firm ITG shows commissions paid to brokerages in the first quarter of 2018 fell by 28% on a year-on-year basis.

An article in the Financial Times suggested the brokerage industry may consolidate in response to the changing landscape.

The article flagged that brokers had been struggling prior to the introduction of MiFID II due to falling commissions and a ‘tepid initial public offering market’ citing Brexit and market volatility as underlying causes.

Another reason that brokers may not be winning as much business is a change of focus by asset managers. This sector is also under pressure due to the growing prevalence of cheaper passive investment funds such as exchange-traded funds.

As pricing pressures eat into the fees that fund managers can charge, it means they are going to be highly selective of the research they buy. (DS)

‹ Previous2018-08-23Next ›

magazine

magazine