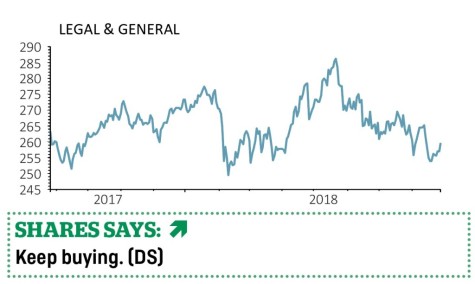

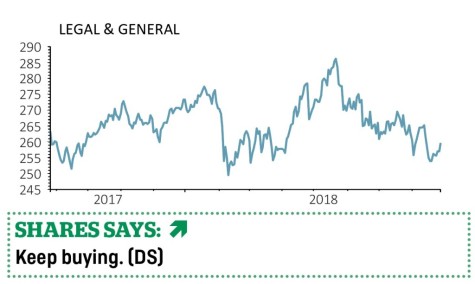

Legal & General

(LGEN) 257.3p

Gain to date: 0.5%

Despite a flat share price performance from life insurer Legal & General (LGEN) since we added it to the Great Ideas portfolio,

we still believe that the company will deliver the goods in the longer term.

Its first half results to 30 June released earlier this month showed steady progress. Operating profit was up 7% to £1.01bn with an increase in its interim dividend per share to 4.6p from 4.3p a year earlier.

One reason we like the company is its ability to bolster its capital position as negative shifts in life expectancy reduce the amount it has to hold to cover annuity payments.

Chief executive Nigel Wilson says the company is reviewing its ‘long term mortality assumptions’ and will make a full release in the second half which will exceed the £332m released in 2017.

The company is active in the pension risk transfer market, taking on bulk annuities from companies.

According to Trevor Moss, analyst at investment bank Berenberg, only a ‘modest’ amount of risk transfer business was completed in the first half.

However, the second half could be a different story as it has a £7bn deal pipeline which it expects to complete during the period.

‹ Previous2018-08-30Next ›

magazine

magazine