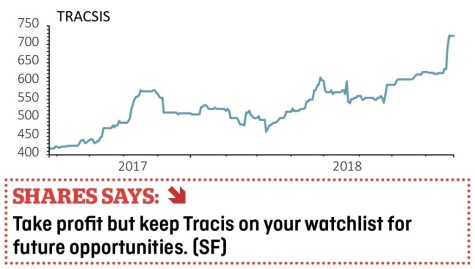

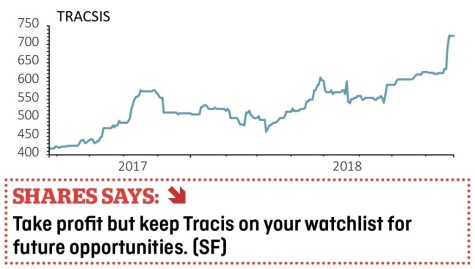

Gain to date: 40.4%

Original entry point:

The transport technology and analytics company has been enjoying a spell of strong demand so while analysts had been anticipating revenue of £36.15m and adjusted operating profit of £8.2m for the year to 31 July 2018, investors can now expect rough £40m and £8.5m equivalent figures.

Tracsis (TRCS:AIM) provides the technology tools to help Network Rail and train operators improve performance, cut capacity problems and keep services running. It also provides technology-led insights on pedestrian and road traffic for infrastructure planning or organising large and complex events.

Encouragingly, both sides have witnessed improved business momentum, but there is also the good news of better profit margins at its traffic data operations, a trend that Tracsis sees continuing into the new financial year and beyond.

Using new technology and analytics to solve problems for often creaking transport systems appears to be an increasingly exciting space. Yet the emerging nature of this niche suggests progress will be more likely in fits and starts rather than linear.

Tracsis remains a high-quality business where self-funded acquisitions have major scope to add extra value beyond organic growth drivers.

As a result, some investors may be happy to hold for the longer-term but a 40% gain in six months suggests that others may choose to take some of that profit off the table now. That is how we see the current situation given a forward price to earnings multiple of 27.6.

‹ Previous2018-08-30Next ›

magazine

magazine