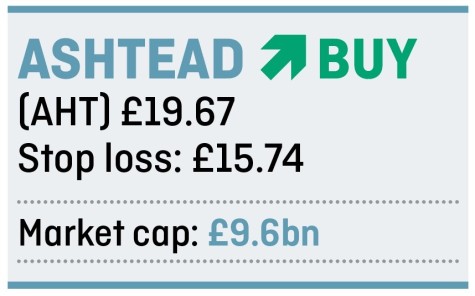

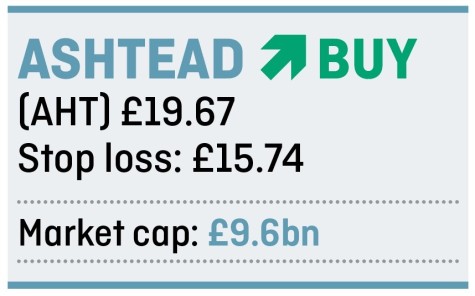

Shares in plant-hire group Ashtead (AHT) have fallen more than 17% in the market rout.

it’s main business is leasing construction and industrial equipment. The US accounts for almost 85% of sales with another 4% coming from Canada and the balance from the UK where it operates the A-Plant brand.

The group recently (11 Sep) reported first-quarter sales up 19%, driven mainly by strong like-for-like rental growth in the US (19%), and raised its full-year profit target.

US construction spending is growing at twice the rate of GDP driven mainly by private non-residential building and big infrastructure projects.

TARGETING BOLT-ON ACQUISITIONS

As the US market remains very fragmented, bolt-on acquisitions can provide a useful kicker to the company’s already strong organic growth.

The company is both investing in its existing business and using funds for these modest-sized deals. It allocated £465m to capital expenditure in its first quarter and spent £145m on M&A. Despite these material levels of investment, the company remains comfortably within its targeted range of 1.5 to two times net debt to EBITDA (earnings before interest, tax, depreciation and amortisation).

Thanks to a high rate of like-for-like growth and the ability to keep taking costs out of the business, most of the increase in sales drops through to operating profit. Ashtead’s operating margin is 30% compared with an average of 10% for companies in the FTSE 100.

Following the fall in its share-price Ashtead now trades on 12 times earnings for the year to April 2019 which seems very cheap for a business with 30% margins and a return on capital of nearly 40%.

A DIVIDEND HERO

The company also yields 19% and strong cash generation underpins an impressive dividend track record. To place this in context, figures from AJ Bell’s latest Dividend Dashboard for the second quarter of 2018 showed that the 2018 yield on the purchase price of Ashtead’s shares ten years earlier was a staggering 44.9%.

Stockbroker Killik & Co comments: ‘We continue to see Ashtead as an attractive investment opportunity. Not only will it be a beneficiary of increased infrastructure spending needed in the US and UK, but it is also playing a secular trend towards increased rental penetration and consolidation of a fragmented market.’ (IC)

‹ Previous2018-10-18Next ›

magazine

magazine