Periods of indiscriminate market weakness are typically good times to pick up quality businesses at a more attractive price. Down more than 14% since the recent market wobble, health and safety products specialist Halma (HLMA) undoubtedly fits the bill as a top-notch stock to buy now.

The FTSE 100 member has a very good track record of growing revenue, profit, cash flow and dividends. In June it released results which marked 15 consecutive years of record revenue and profit and the 39th consecutive year it had hiked the annual dividend by 5% or more.

The reason Halma’s shares have been so heavily sold off in the past few weeks is probably concern about valuation. The shares were trading on more than 30 times March 2019 earnings ahead of the market correction. Now at 25.9-times it is trading at a more modest premium to its rough earnings multiple of 22 from four years ago, since which the shares have more than doubled.

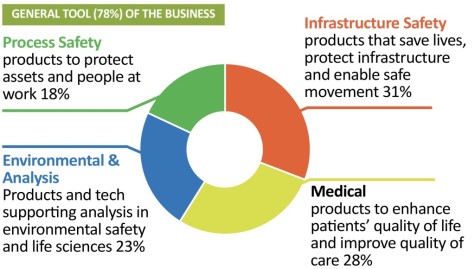

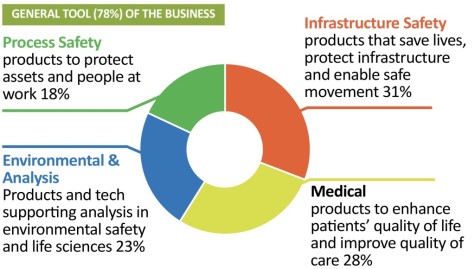

Buckinghamshire-headquartered Halma makes, and sells globally, a diverse range of equipment required to meet regulations on health, safety and the environment. This can encompass everything from hazard detectors to environmental protection kits and sensors.

FORENSIC FOCUS ON THE RIGHT MARKETS

The company bolsters organic growth with select acquisitions and forensically targets markets which benefit from demographic trends like ageing populations and/or stricter safety rules. The company’s own language around its business model is refreshingly simple.

Its objective is to double every five years. ‘We aim to achieve this through a mix of acquisitions and organic growth. Return on sales in excess of 18% and return on capital employed over 45% ensure that cash generation is strong enough to sustain investment for growth and increase dividends without the need for high levels of external funding,’ says the company.

Under its Halma 4.0 strategy, it is also buying up quality niche businesses which it can help develop within the group.

Assuming half year results on 20 November are the usual model of consistency then we would expect the shares to start recovering. Even if they don’t move up much, we still think this is an outstanding business to buy and hold for the long term. (TS)

‹ Previous2018-10-18Next ›

magazine

magazine