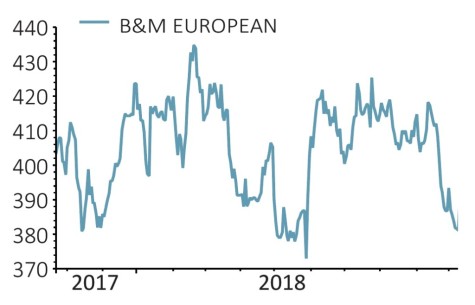

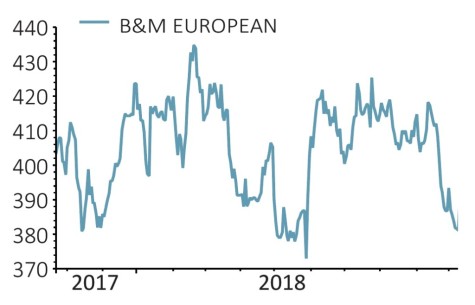

B&M EUROPEAN VALUE RETAIL (BME) 391.2p

Loss to date: 6.4%

We’re sticking with our bullish stance on multi-price discounter B&M European Value Retail (BME), albeit irked by a share price drift to 391.2p that leaves our trade languishing in a modest loss.

B&M’s acquisition (19 Oct) of Babou Stores in France for €91.2m provides a base which will enable the Simon Arora-led firm to develop and grow its proven, profitable value retail model across the channel.

Babou is a 95-store-strong chain of discount general merchandise outlets. The average store size, location and customer base of Babou are comparable to the flourishing B&M Homestore operation in the UK.

France, alongside the existing German and UK markets in which B&M operates, has attractive dynamics in terms of overall size, the rising popularity of the discount channel and the healthy operating margins achieved by several incumbent players.

While the retail sector struggles, B&M is a self-funded growth business, a cash generative concern offering a play on trends towards value and convenience, and scope for higher ordinary dividends and special payouts on top.

Numis Securities welcomes the Babou deal, moving its recommendation from ‘add’ to ‘buy’ following a soft share price run; the broker’s 475p price target implies 21.5% upside from these levels.

‹ Previous2018-10-25Next ›

magazine

magazine