The respective earnings seasons in the US and Europe reflect an increasing disparity in corporate health.

US firms, buoyed by tax cuts and a robust economy, are flying high. On 22 October, after nearly a fifth of US companies had reported their third quarter numbers, Saxo Bank’s head of equity strategy Peter Garnry noted their earnings were up by

an average of 6.5% year-on-year.

Despite these positive results, negative market sentiment means US indices continue to struggle and before investors get too carried away, the major technology companies, arguably the most important names to watch given their size, are yet to report.

Amazon, Intel and Google’s parent company Alphabet post tonight (25 October) after the market close in the US.

European firms are not faring as well as their American counterparts. Garnry reckons up until now revenue and earnings are in a negative territory, reflecting exposure to faltering emerging markets. He does add that European stocks could be ‘tactically interesting’ with US stocks looking overvalued in his view.

EUROPEAN FIRMS ARE MISSING EXPECTATIONS

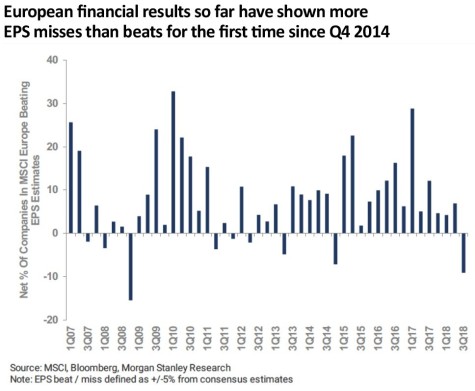

Investment bank Morgan Stanley says of the European companies to report so far, 23% have beaten earnings expectations and 32% have missed forecasts.

If this trend continues it would represent the first net miss since the fourth quarter of 2014.

All broad sector groupings in Europe are seeing at least modest earning downgrades and the bank’s team also highlight the weak share price reaction to earnings reports. They explain: ‘Earnings per share beats have, on average, seen underperformance on the day of the results, while sales results have seen misses punished by more than beats have been rewarded.’

Morgan Stanley adds: ‘One of the key themes to come out of the second quarter results season was signs of margin pressure, as a strong top-line (revenue) beat was met with merely okay earnings figures.

‘Again we highlight that we only have limited results so far, but (third quarter) sales have seen a small net beat relative to the earnings miss, suggesting margin pressures continuing.’ (TS)

‹ Previous2018-10-25Next ›

magazine

magazine