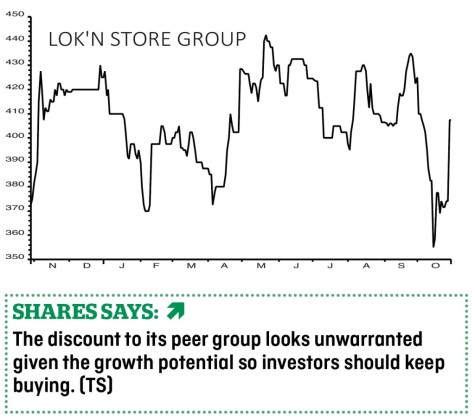

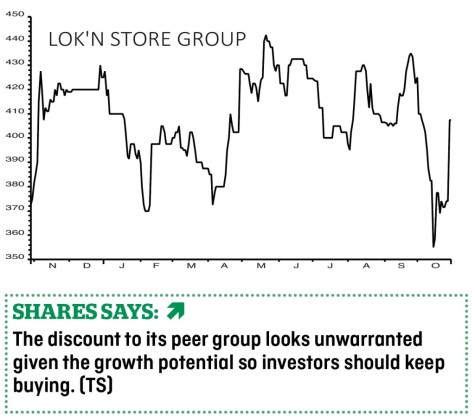

Lok’N Store (LOK:AIM) 414p

Gain to date: 1.4%

A very strong set of full year results (29 Oct) has cast our positive call on self-storage play Lok’N Store (LOK:AIM) in a more flattering light.

The shares gained 10% in the wake of its publication of numbers covering the 12 months to 31 July. These showed net asset value per share up 15.3% to 480p, earnings before interest, tax, depreciation and amortisation (EBITDA) up 12.3%, and the annual dividend up 10% to 11p.

Chief executive Andrew Jacobs, who founded the business more than 20 years ago, says the dynamics behind the industry remain strong as the company outlines plans to increase the number of stores by 13 units to 42 in the coming years.

FinnCap analyst Guy Hewett reiterated his ‘buy’ recommendation and upped his price target from 521p to 609p.

He says: ‘Self-storage peers are valued at a 37% premium to latest historic net asset value (NAV). Lok’nStore is valued at a 22% discount to its July 2018 NAV and a 10% discount to 2017.

‘Alongside our forecast of faster EBITDA growth than its peers, we view this as a very attractive buying opportunity.’

‹ Previous2018-11-01Next ›

magazine

magazine