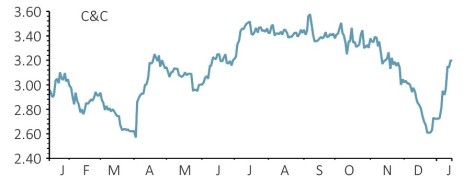

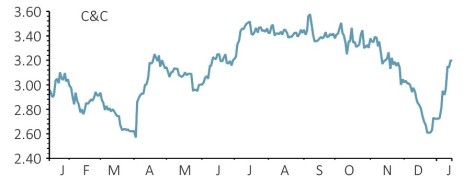

C&C (CCR) €3.19

Loss to date: 4.5%

Our bullish call on Irish brewer C&C (CCR) may be 4.5% underwater, but we’re optimistic a recent share price rebound has further to go.

The premium drinks company behind Bulmers, Tennent’s and Magners issued a positive update (10 Jan) covering the four months to 31 December, with C&C trading in line with expectations.

We originally argued Dublin-headquartered C&C was at a turning point following the acquisition of Matthew Clark and Bibendum out of the ashes of Conviviality. So it was pleasing to learn that operational delivery and customer service at both Matthew Clark and Bibendum were ‘very strong and ahead of plan’ in the four month period and the two businesses delivered ‘an exceptional operating performance over the key Christmas period’.

Across the rest of C&C, positive trading momentum has continued into the second half and CEO Stephen Glancey seems confident about the outlook for the beer, cider, wine and spirits seller.

‘In Scotland and Ireland our combination of leading brands and distribution assets is highly resilient, cash generative and delivering growth. With a strong balance sheet and normalised cash flow conversion of 60-70% of EBITDA we are poised to provide enhanced shareholder returns,’ says Glancey.

SHARES SAYS: Cash-generative C&C is looking a much healthier business and we’re heartened by the Christmas performance and positive group-wide momentum.

‹ Previous2019-01-17Next ›

magazine

magazine