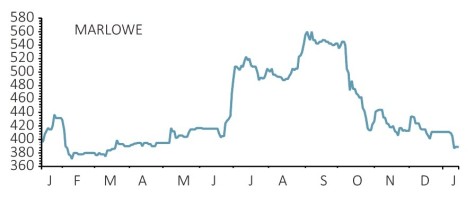

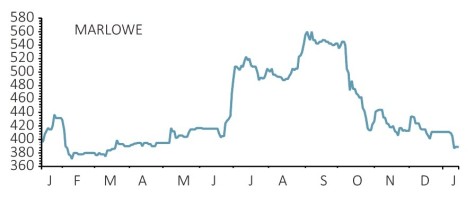

Marlowe (MRL:AIM) 389p

Loss to date: 8.7%

Don’t be dismayed by Marlowe’s (MRL:AIM) share price failing to keep up with the broader market this year. While equities in general have started to move forward in 2019, Marlowe has drifted down slightly and we see no reason for the price weakness.

The fire and water safety expert raised £7m just before Christmas at 410p per share, which was a 2.2% premium to the market price at the time and the fundraising was oversubscribed, showing that institutional investors remain eager to support the company’s growth plans.

It used that money, plus existing cash and debt facilities, to buy William Martin, a property-related health and safety audit and consultancy service group, for £30m. A large amount of William Martin’s earnings are recurring and it made £2.4m pre-tax profit in the most recent financial year.

Marlowe says the acquisition will be at least 10% earnings enhancing in the first full year of ownership, which one would have thought would be positive for the share price.

In fact, broker Cenkos upgraded its adjusted EBITDA (earnings before interest, tax, depreciation and amortisation) forecasts for the year to March 2020 by 20% to £14m. This comes off the back of similar upgrades to earnings in December for the current financial year and 2020 following its half

SHARES SAYS: Positive earnings momentum is normally a good share price catalyst so remain patient. We remain big fans of the stock. Keep buying. (DC)

‹ Previous2019-01-17Next ›

magazine

magazine