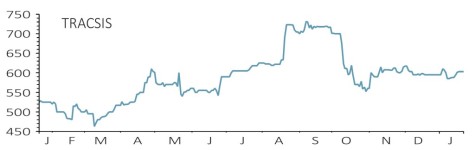

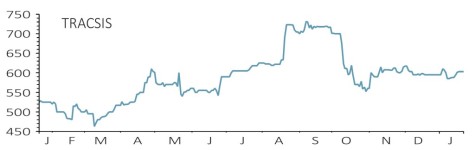

Gain to date: 17.1%

Quite a bit has happened since the start of the new year at Tracsis (TRCS:AIM) with the acquisitions of Compass Informatics and event traffic planning provider Cash & Traffic Management recently signed off.

These will bolster the Traffic and Data Services (TDS) part of the transport technology and analytics company, bringing extra scale, some new clients and offering good cross-selling opportunities. Both are classic Tracsis buys, relatively inexpensive, with solid profitable growth and recurring revenue.

This is important since TDS is the lower margin bit of the company, with earnings before interest, tax, depreciation and amortisation (EBITDA) margins of 12.5% last year. That compares to roughly 36% margins earned on Rail Technology and Services (RTS), the other part of the company.

But trumping that was news earlier in January that chief executive John McArthur is standing down. This is undoubtedly a blow since he has created huge value for shareholders in the 10-plus years on the stock market. The stock floated at 40p.

Ricardo (RCDO) executive Chris Barnes will take the company forward from 4 February, with a suitable handover period planned.

That McArthur will still be around in a consultancy capacity to help on future acquisitions is highly reassuringly that despite the management change, Tracsis will be sticking very much to its growth knitting.

SHARES SAYS: Still a long-term buying opportunity.

‹ Previous2019-01-24Next ›

magazine

magazine