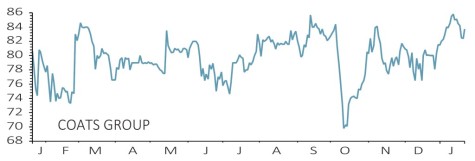

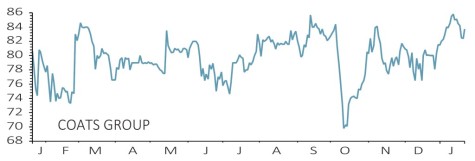

Coats (COA) 84.4p

Gain to date: 9.2%

Sometimes price isn’t everything when selling assets. That is certainly the case with threads expert Coats (COA) whose disposal of its North America Crafts business for a mere $37m (or 0.2 times revenue) may initially look a poor deal.

In reality selling the business for any price is strategically sound. It has been the only real problem area of the group and its sale to Spinrite leaves a more focused group firing on all cylinders.

Canaccord Genuity analyst Caspar Trenchard says the crafts business made 4% net margins versus 13.5% from Coats’ industrial threads operations.

By removing crafts from the equation, group net margins expand from 12.3% to 13.5% and EBITDA (earnings before interest, tax, depreciation and amortisation) margins expand from 14.3% to 16.5%.

‘Crafts was substantially diluting group returns,’ says Trenchard. ‘As a progressively higher margin business emerges investors can expect an expansion of the rating for the shares. Crafts has been a perennial distraction and its sale is, in our view, transformational.’

SHARES SAYS: We flagged the crafts arm was the weak part of the business in our original article on Coats. Removing this operation from the business effectively removes one of the key risks to the investment case. Keep buying

‹ Previous2019-01-24Next ›

magazine

magazine