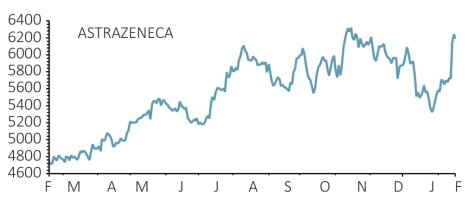

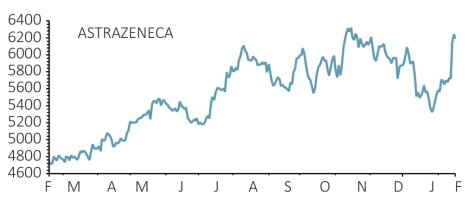

AstraZeneca (AZN) £60.84

Loss to date: 3.4%

Pharmaceutical giant AstraZeneca (AZN) beat product sales forecasts by 2% in the three months to 31 December, driven by new medicines, its oncology drugs portfolio and sales growth in China. Product sales grew 5% to $5.77bn in the quarter.

The results, published on 14 February, confirm that AstraZeneca achieved its first year of sales growth since 2009.

Oncology drugs were among the standout performers at AstraZeneca over the fourth quarter period with Tagrisso sales soaring 95% to $594m and Lynparza sales jumping 24% to $209m.

Tagrisso, which represents 10% of overall product sales, beat forecasts by 5% while Lynparza sales were 9% ahead of expectations, according to UBS analyst Jack Scannell.

In emerging markets, AstraZeneca’s largest region by product sales, the company revealed 8% sales growth to $1.77bn over the period. China represents nearly half of emerging market product sales and performed well as revenue rose 17% to $948m in the fourth quarter, driven by new medicine launches.

AstraZeneca forecasts a high single-digit percentage increase in product sales in the year to 31 December 2019.

SHARES SAYS: We are pleased to see AstraZeneca is gaining momentum with its oncology drugs portfolio and enjoying strong growth in China. Keep buying.

‹ Previous2019-02-21Next ›

magazine

magazine