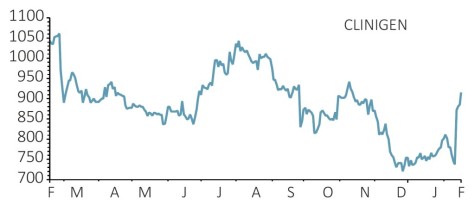

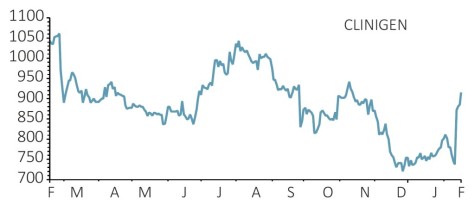

Gain to date: 4.3%

Shares in pharma firm Clinigen (CLIN:AIM) have shot up after it agreed to buy the US rights to Novartis’ cancer drug Proleukin.

The deal, expected to complete in April, will enhance Clinigen’s profit in the current financial year ending 30 June and is forecast to boost group earnings per share by at least 25% next financial year.

Proleukin is now Clinigen’s biggest product and has the potential to significantly enhance earnings. The deal also means Clinigen has global rights to the drug, having bought the ex-US rights last summer.

The company is paying $120m, a further $60m in deferred payments one year after the transaction completes, and a possible $30m contingent on increased sales.

Numis analyst Stefan Hamill forecasts that Proleukin will increase earnings per share by 24% in the financial year to June 2021 and by 23% in the following year.

Following the acquisition, net debt-to-earnings before interest, tax, depreciation and amortisation at Clinigen is expected to rise to 2.4-times before falling to 2.0-times by the end of this year.

SHARES SAYS: Clinigen’s acquisition of Proleukin appears to be a wise strategic move that should support further growth for the company. Keep buying the shares.

‹ Previous2019-02-21Next ›

magazine

magazine