Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Big cheese Glanbia is fighting fit for the future

Food group Glanbia (GLB) is one of those lesser-known but highly exciting large cap stocks. The nutritional ingredients, cheese and dairy packaged foods giant is growing by organic and acquisitive means.

Consumer demand for Glanbia’s brands and nutritional ingredients is underpinned by long term global health and wellness trends.

Investment bank Berenberg argues: ‘Few other branded food companies continue to deliver such consistently strong annual volume growth, despite quarterly volatility due to retailer seasonality.’

Canadian group Saputo’s recent £975m takeover bid for Dairy Crest (DCG) only serves to highlight the strategic attractions of well-invested manufacturers with strong brands.

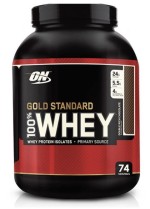

Kilkenny-headquartered Glanbia has a sustainable competitive advantage in the resilient global sports nutrition market, where investment in a strong innovation pipeline leaves the company well placed for profitable growth.

In addition, Glanbia has entered the $8bn weight management category through the $350m acquisition of the growing SlimFast brand.

With deep roots in the dairy industry, the €5.5bn cap also supplies innovative nutritional solutions for food producers based on whey, specialty grains and other dairy and non-dairy ingredients, while producing and marketing American-style cheddar cheese in the US.

Increasing use of whey protein in food and beverages generally is a tailwind, while Glanbia has beefed up its ingredients sector capabilities via the $89m acquisition of US-based non-dairy ingredient solutions business Watson.

Appetite for Glanbia’s shares has been voracious since full year results (20 Feb) which allayed concerns over volumes and margins in the Glanbia Performance Nutrition (GPN) division.

And despite volatile input costs, and spending on acquisitions and investments in cheese manufacturing joint ventures in Ireland and the US, operating cash flow stepped back up in 2018, rising from €185m to €301.7m.

Risks to note include generating more than 80% of its earnings in US dollars and reporting in euros; and any milk supply shortages could limit Glanbia’s cheese and whey production.

Any future entry into sports nutrition by a major consumer goods or pharmaceuticals group, or a surge in demand for cheaper private label products, could compress Glanbia’s margins.

Based on Berenberg’s forecast net debt-to-EBITDA ratio of just 1.3-times, Glanbia appears well-financed with acquisitive firepower aplenty.

For 2019, it is forecast to grow adjusted pre-tax profit, earnings and dividends to €336m (2018: €313m), 99.5c (2018: 91c) and 27.9c (2018: 24.2c) respectively.

While its shares trade on the London Stock Exchange it doesn’t have the right type of listing to qualify for inclusion in FTSE indices. If it did, Glanbia would be big enough to slot into the FTSE 100.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Big News

- News on Vodafone, RELX, GoCompare and more over the past week

- A tale of two founders: Ted Baker and Superdry

- Smithson beats its benchmark in maiden set of results

- What happens next with Brexit and what could it mean for investors?

- New IMI boss hoping to use his Halma-earned growth magic

- Take advantage of price dip in manufacturer Coats

magazine

magazine