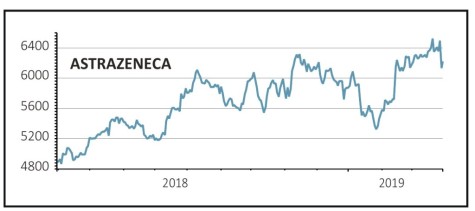

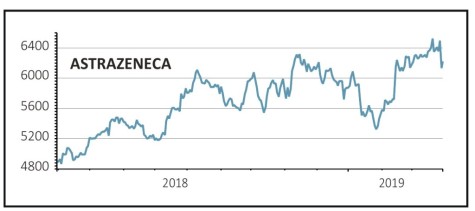

AstraZeneca (AZN) £61.67

Loss to date: 2.1%

AstraZeneca’s (AZN) $6.9bn deal with Japan’s Daiichi Sankyo to develop and sell the latter’s breast and gastric cancer drug hasn’t gone down that well with the market – more focused on how it has done the deal rather than why.

Under the deal, AstraZeneca has agreed to pay $1.35bn upfront and contingent payments of up to $5.55bn, in addition to $1.75bn for sales-related milestones.

Morningstar analyst Damien Conover says he is surprised the pharma group has raised $3.5bn by issuing new shares to help fund the deal and to pay off a bond, saying debt would have been a better route.

However, the strategy of partnering with Daiichi Sankyo looks sound as it will complement AstraZeneca’s growing cancer drug portfolio.

Shore Capital analyst Adam Barker is positive about the deal as DS-8201 is being assessed in five trials for breast and gastric cancers, contributing to AstraZeneca’s pipeline.

The company has been under pressure for some time to replace lost cash flows from products losing patent protection in order to revive earnings growth and keep generating enough cash to fund dividends.

SHARES SAYS: We remain excited about

AstraZeneca’s prospects and believe the Daiichi Sankyo deal looks sensible. Keep buying.

‹ Previous2019-04-04Next ›

magazine

magazine