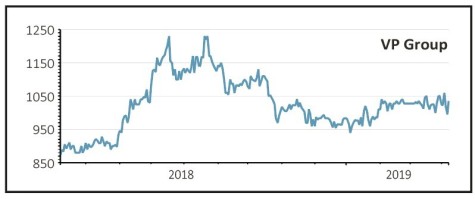

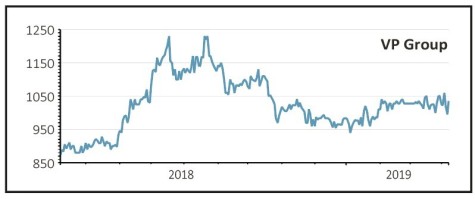

VP Group (VP.) 916p

Loss to date: 8.4%

There is good and bad news for equipment rental firm VP Group (VP.) which has made us reappraise the investment case.

Its UK division has seen steady demand in its core sectors of infrastructure, construction and housebuilding, while the integration of Brandon Hire (purchased in November 2017) should be completed within the next six months and will transform its Hire Station tool hire business.

Meanwhile the international division has seen strong demand at its TR testing and measurement equipment rental business in Asia although the Airpac Bukum offshore oil and gas services business is still weak.

However, on 9 April VP was named in a Competition and Markets Authority (CMA) probe into possible ‘price fixing’ in the market for rented groundworks products.

The market didn’t like this news and the shares fell by more than 10%, wiping out our earlier gains. VP is reviewing the CMA’s findings and as of last September it had £15m cash on the books which it could use to pay a fine, should there be one.

Given the uncertainty, the sensible course of action is to close our position for a small loss and await the outcome of the probe.

SHARES SAYS: Err on the side of caution and sell now.

‹ Previous2019-04-11Next ›

magazine

magazine