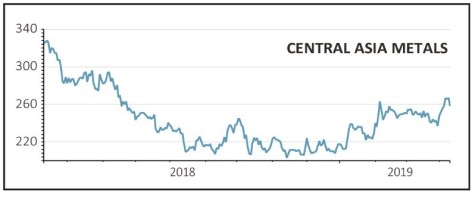

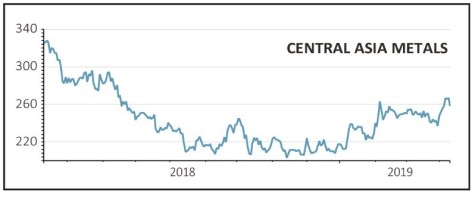

Central Asia Metals (CAML:AIM) 257.5p

Gain to date: 8.9%

Full year results from the metals miner showed positive earnings growth and a decent reduction in debt. However, the market focused on a 12% cut in the dividend to 14.5p, sending its shares down on the day.

It is worth noting that Central Asia Metals changed its dividend policy following the acquisition of the Sasa lead/zinc mine in 2017. It will now pay between 30% and 50% of annual free cash flow as dividends with the latest full payment towards the upper end of this range (44%).

Chief executive Nigel Robinson tells Shares that the company changed its policy because it is now a much bigger business and needs to balance cash returns with paying down borrowings, particularly as it took on extra debt to buy Sasa. ‘Our yield is about 5.5% which is still very generous,’ he adds.

It is currently facing inflationary pressures from zinc treatment charges but Robinson says Sasa still has competitive costs, adding that the mine is on the cusp of being in the lowest cost quartile in the industry.

Central Asia Metals is looking for acquisitions in the copper, lead and zinc space in order to keep growing the business.

SHARES SAYS: The market has overreacted to the dividend news. Keep buying as it is a great way to play the copper and zinc market.

‹ Previous2019-04-11Next ›

magazine

magazine