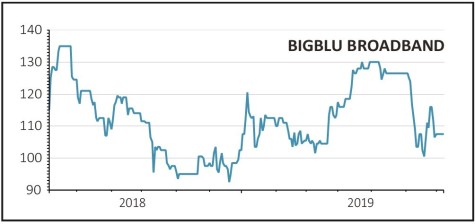

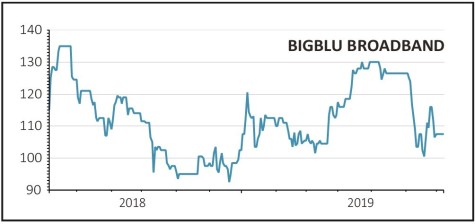

BIGBLU BROADBAND (BBB:AIM) 108p

Gain to date: 1.9%

Investor enthusiasm for Bigblu Broadband’s (BBB:AIM) superfast satellite internet access story has ebbed again after the shares’ strong April rally, but the underlying trends look very positive.

Net new customer growth is accelerating and gross margins are on the rise, up from 37.4% to 43.7% for the half year to 31 May. What this tells us is that Bigblu is seen as a competitively-priced supplier for an increasing number of consumers living in the relative sticks and with limited alternative options to get superfast broadband.

It helps that more and more people want access to streaming services like Netflix, Amazon Prime or Now TV and are happy paying more for the privilege. Bigblu’s new 50Mbps download speed and unlimited usage package could really strike a chord with users.

Some investors might fret about the £5m jump in net debt to £16.9m, but we believe that tallies with the extra working capital needed to support faster customer growth. There are also earn-out payments from past acquisitions to factor in.

Full year estimates call for £10.1m of EBITDA (earnings before interest, tax, depreciation and amortisation) on £62.5m of revenue. So the half year’s £4.3m EBITDA and £30.5m revenue equates to 43% and 49% of the respective full-year forecasts.

SHARES SAYS: There’s still work ahead to hit expectations but the underlying trends are very promising. Still a buy.

‹ Previous2019-07-11Next ›

magazine

magazine