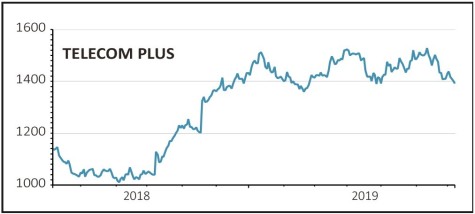

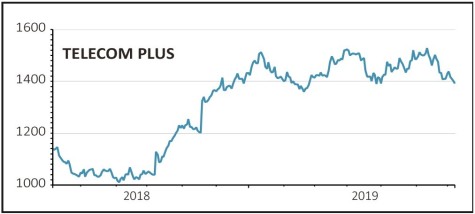

TELECOM PLUS (TEP) £13.94

Gain to date: 2.2%

At a time when some historically reliable income paying stocks have disappointed, the value of dividends from multi-utility supplier Telecom Plus (TEP) should not be underestimated. The 52p per share dividend paid to shareholders for the year to 31 March 2019 would imply a very decent inflation-busting 3.8% yield on our original entry price last December, and growth is set to accelerate.

Analysts have forecasts dividends worth 56.1p for the current financial year and 64.5p next financial year, both implying attractive returns versus the dismal rates you’d get on cash savings.

The latest financial results detailed modest growth in revenue (£804.4m) and adjusted pre-tax profit (£56.3m) but that was in the face of an exceptionally mild winter that meant far less gas demand.

The new energy price cap is also an issue to stomach, although management believes it makes the industry fairer.

Telecom Plus says its customer churn rate has remained steady at around 12% a year, which it claims to be half the average rate across the energy sector.

SHARES SAYS: The company remains a solid growth and income play. Keep buying.

‹ Previous2019-07-11Next ›

magazine

magazine