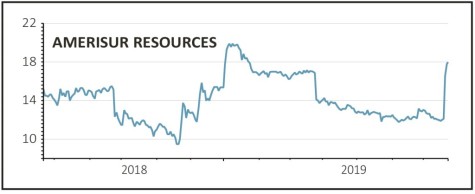

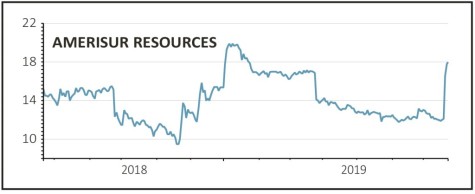

Amerisur Resources (AMER:AIM) 17.85p

Gain to date: 32.2%

For quite some time our faith that Colombian oil producer Amerisur (AMER:AIM) represented a good opportunity for investors was looking shaky, particularly after disappointing exploration results in the spring.

However, it looks like the industry has recognised the potential that we flagged and the market had ignored. On 22 July Amerisur confirmed it had received a $257m takeover approach from French outfit Maurel & Prom but had concluded that its offer undervalued the company.

Maurel & Prom is pitching a possible offer of 12.5p per share in cash and 4.5p per share in its own shares.

Amerisur says a ‘number of conversations’ have taken place with interested parties after a formal sales process was launched on 19 July and that it was ‘confident that a competitive process involving several of these potential counterparties can be completed to the benefit of all shareholders’.

While shareholders will be hoping for a higher offer than the one already rebuffed, it is unlikely the company will get anywhere close to the peaks above 66p reached in 2014.

SHARES SAYS: Take advantage of the recent share price strength and lock in a profit by selling now.

‹ Previous2019-07-25Next ›

magazine

magazine