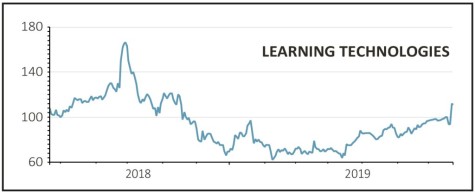

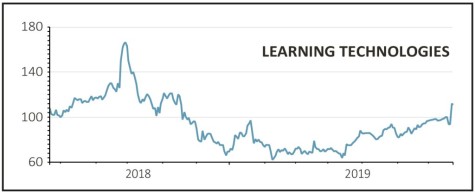

LEARNING TECHNOLOGIES (LTG:AIM) 114.8p

Gain to date: 53%

Corporate online trainer Learning Technologies (LTG:AIM) is knocking it out of the park this year and investors are jumping in for the ride.

In just three months since our original Great Idea at 75p, the stock has soared an impressive 53% and analysts, like Shares, believe there is more to come.

On 22 July the £767m business announced that earnings before interest and tax, otherwise referred to as operating profit, would be ‘materially ahead’ of market expectations.

Forecasts had been pitched at £35.3m operating profit on approximately £128m revenue. Analysts now see £38m to £40m operating profit this year.

This is largely because of cost efficiencies being driven out of past acquisitions, including NetDimensions and PeopleFluent, thereby boosting profit margins. Operating profit margins shot up from 26.3% to around 32% in the half year to 30 June, according to the trading update.

That’s the good news. The really good news is that there are extra value levers still to pull, particularly within PeopleFluent, a business that had been run for cash but is starting to get a new lease of life.

SHARES SAYS: Keep buying.

‹ Previous2019-07-25Next ›

magazine

magazine