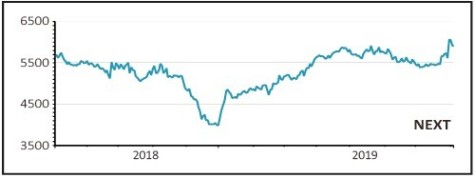

NEXT (NXT) £59.20

Gain to date: 41.3%

Our bullish call on clothing-to-homewares colossus Next (NXT) is now 41.3% in the black. The latest upwards share price catalyst was a surprisingly positive second quarter trading update (31 Jul) and accompanying upgrades for both annual profits and sales.

Second quarter full price sales grew by a better than expected 4% and the retail bellwether upgraded full price sales guidance for the year to next January from 1.7% to 3.6% and its pre-tax profit guidance by £10m to £725m, marginally up on last year.

Despite tough prior year comparatives, and fears May and June were a washout, the Simon Wolfson-steered high street fashion retailer delivered solid quarterly growth with a sales boost as the sun shone in July combined with good seasonal ranges.

‘It plays to our theme that good shopkeepers can prosper, whatever the weather’, said brokerage Shore Capital.

While online remains the growth driver for Next, helping to offset declines in the physical store estate, brick and mortar stores form a key component of its winning click and collect service. One of the key reasons to own the stock is Next’s enviable cash generation and capital returns, as reflected in a bumper £300m share buyback programme.

SHARES SAYS: Keep buying.

‹ Previous2019-08-08Next ›

magazine

magazine