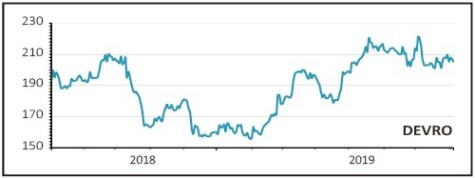

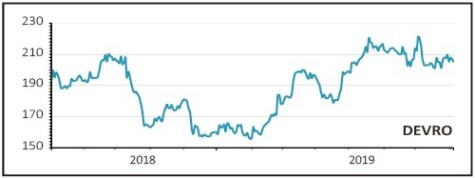

DEVRO (DVO) 204p

Gain to date: 6.5%

Following bouts of weakness in the wake of our September 2018 recommendation, which almost saw our stop loss breached, shares in Devro (DVO) have regained some sizzle and are trading 6.5% in the money.

The Moodiesburn-based sausage skin maker’s first half results (31 Jul) demonstrated that Devro is making positive progress with cost savings and growth opportunities and is well placed for the second half.

Despite a slight decrease in revenue to £119.2m (2018: £120.2m), with strong volume growth in China and North America offset by weaker performances in Japan, Russia & East and Latin America, underlying pre-tax profit grew by 4% to £14.9m and free cash flow generation improved materially.

A global leader in collagen casing technology, the food producer has compelling growth opportunities in confectionery and protein snacking in markets such as China.

Bulls believe volume growth will materialise in the second half, underpinned by the roll out of Fine Ultra, Devro’s more robust casing that can withstand products being deep fat fried, supported by ‘a number of commercial initiatives to accelerate growth’.

Numis Securities forecasts improved pre-tax profits of £34.8m (2018: £29.8m) for earnings of 17.1p and a 9.5p dividend, ahead of an estimated £37.5m, 18.8p and 9.9p respectively for fiscal 2020.

SHARES SAYS: Keep the faith.

‹ Previous2019-08-08Next ›

magazine

magazine