TI Fluid Systems (TIFS) 195.6p

Loss to date: 5.5%

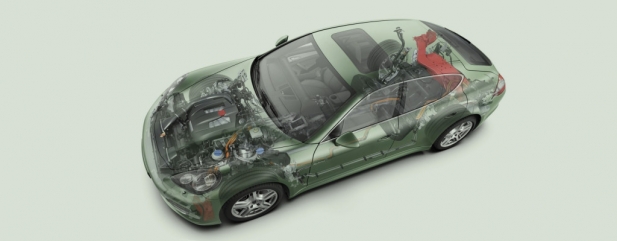

The long-term drivers of increasing globalisation, tighter regulations and electrification remain in place for TI Fluid Systems (TIFS).

Against that positive backdrop, slowing growth exhibited by China and fears of a global slowdown has weighed on the shares. Analysts have recently downgraded their revenue and profit projections by around 5% to 7%.

TI Fluid Systems is able to mitigate softer markets due to its flexible cost base, where fixed costs only representing 15% of revenue.

The company’s leading market positions in performance and safety critical products mean that it can grow faster than the underlying market and achieve higher operating margins and substantial free cash flow.

The total addressable market will rise from €1.3bn in 2018 to between €13.6bn to €19.5bn in 2026 according to IHS Markit and the company’s estimates.

Although this sounds dramatic, it will only take the market share of hybrid to 38% and electric to 11% of the total market.

SHARES SAYS: The company’s global footprint, with leading market positions, puts it on the front of the grid in the race to deliver a greener future. The shares remain too cheap and don’t reflect the quality of the business. According to broker Peel Hunt the shares offer a free cash flow yield of 11.1%. Keep buying.

‹ Previous2019-10-03Next ›

magazine

magazine