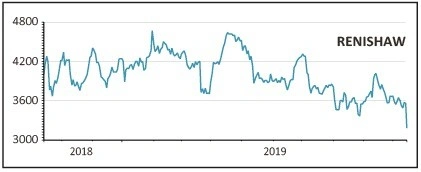

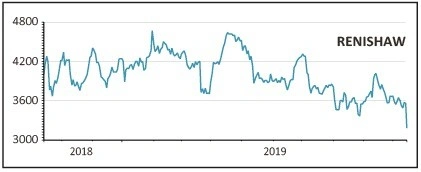

Renishaw (RSW) £31.94

Loss to date: -16%

Original entry price: Buy at £38.04, 20 December 2019

High quality engineering outfit Renishaw (RSW) has seen its share price come under considerable pressure after the latest of several downbeat updates from the company in 2019.

A first quarter update, for the financial year running to 30 June 2020, showed pre-tax profit for the three months through September down 85% to £5.1m, while adjusted profit was off 87% to £32.6m.

Revenue slid 19% to £124.6m. The company said its metrology (precision measurement) business had benefited from a large number of orders in the previous corresponding period from end-user manufacturers of consumer electronic products.

Revenue in the healthcare business fell due to the timing of additive manufacturing machine sales into the healthcare market.

The company says it is confident the structural drivers in its end markets remain intact, however its short-term prospects look heavily tied to the global economy and, in particular, whether any kind of resolution can be found to the current trade war between the US and China.

Previously in 2019 the shares have bounced back strongly in the wake of disappointments but sentiment might be more difficult to revive this time round.

SHARES SAYS: We continue to believe in the long-term potential of the business but acknowledge it could be a bumpy ride in the near term.

‹ Previous2019-10-17Next ›

magazine

magazine