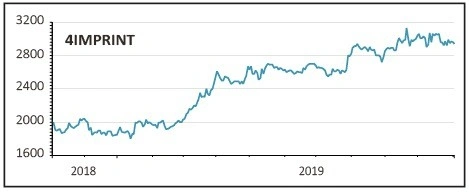

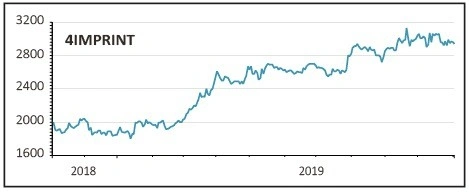

4imprint (FOUR) £30.30

Gain to date: 54.4%

Original entry price: Buy at £19.62, 7 February 2019

Promotional products firm 4imprint (FOUR) is enjoying positive share price momentum with a new trading update providing the latest catalyst.

The company, which ascended to the ranks of the FTSE 250 in June, expects a ‘strong full year trading performance, with revenue growth of around 16% over 2018’.

Demand in the second half has remained robust, with growth in both new and existing customer orders consistent with that seen in the first half. This suggests the company’s recent investment in its own marketing is paying off.

The company also completed the expansion of the Oshkosh distribution facility, which became fully operational in September, within the original $5m capital budget.

As house broker WH Ireland observes, this will provide 40% more capacity for the group heading into 2020.

Although investors will be mindful of the company’s US exposure, given it accounts for more than 90% of its business and there are growing fears over a slowdown in the world’s largest economy, 4imprint still has less than 5% share of a market worth around $20bn. This suggests there is further opportunity to grow.

SHARES SAYS: We will be keeping a close eye on any sign of a US slowdown affecting performance but remain positive for now.

‹ Previous2019-11-07Next ›

magazine

magazine