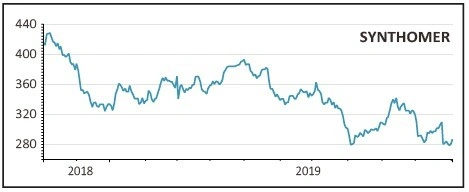

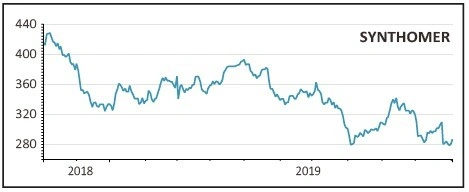

Synthomer (SYNT) 287p

Loss to date: 13%

Original entry point: Buy at 330p, 12 September 2019

A profit warning from chemicals firm Synthomer (SYNT) has highlighted some of the pitfalls of investing in the sector and provided a reminder of the need for patience in investing.

In a trading update, Synthomer said the ‘growing weakness in the global economy has created a more challenging backdrop’ for the chemicals industry, resulting in a slower trading environment throughout the third quarter of its financial year.

Given the wide-ranging uses for their products, chemicals companies are more exposed than many other sectors to wider macroeconomic situations, for better or worse.

The decline in Synthomer’s share price reflects the direction of the global economy or at least where people feel it is heading.

But the long-term fundamentals for Synthomer remain the same. A deal to acquire US-based Omnova Solutions means the firm is on the cusp of global expansion as it tries to keep up with demand for its products.

According to Canaccord Genuity analyst Alex Brooks, Synthomer’s underlying earnings are also growing faster than its peers, with the business now dominated by highly profitable speciality units.

In addition, the firm is one of just three major players in two European and Asian rubber markets, sectors where profit stability is much better now than in the past, according to Brooks.

SHARES SAYS: The long-term fundamentals remain unchanged. Stick with the shares.

‹ Previous2019-11-07Next ›

magazine

magazine