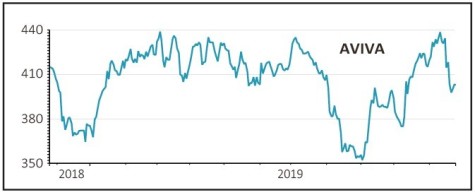

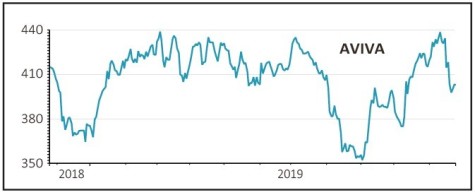

Aviva (AV.) 403p

Loss to date: 6.3%

Original entry point: Buy at 430p, 2 May 2019

The roller-coaster ride at insurer Aviva (AV.) continued this month with the shares almost making a new 12-month high a fortnight ago only to hurtle back towards earth, hence the update on our positive call.

The tipping point was the 18 November announcement that ‘following a thorough review of options for the Singapore business, including seeking offers, Aviva has concluded that the best value for shareholders will be achieved by retaining the business’.

Investors, who have criticised the firm’s ‘clunky’ structure and were expecting the insurer to sell its Singapore unit, sold the shares down in frustration at the lack of progress.

In Aviva’s defence most global and regional insurers already have operations in Singapore and there was no urgency to sell. Moreover the unit is profitable, generating around half the Asian business’s operating earnings.

At the company’s recent strategy day (20 Nov) the firm announced new financial targets including Solvency II returns on equity, a reduction in costs and leverage and a ‘progressive’ dividend policy.

SHARES SAYS: With the shares trading on a yield of 8.1% and a price to earnings ratio of just 7.7 for next year we feel investors should keep holding the shares.

‹ Previous2019-11-28Next ›

magazine

magazine