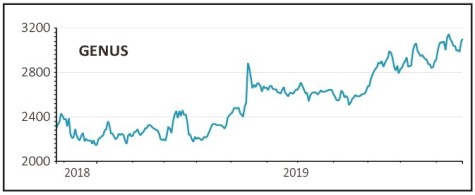

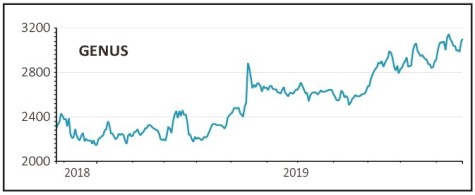

Genus (GNS) £30.78

Gain to date 8.2%

Original entry price: Buy at £28.46, 19 September 2019

At a recent healthcare conference bovine and porcine genetics company Genus (GNS) gave investors an update on the key developments for the business including African Swine Fever (ASF) and the potential of the Indian market where Genus holds a unique position.

According to management the ASF related culling of the pig herd has reduced the global supply of animal protein by 7% while also pushing up the hog price in China to new highs of around 40 RMB per kilo.

The company highlighted that the disease is still not under control and has in fact spread to neighbouring countries. This represents a further opportunity for Genus over the next five years as farmers rebuild their herds.

As the only international player in India, Genus is in unique position to capitalise on the growth opportunity here.

The company’s Sexel product allows farmers to produce female calves for milk with almost 100% certainty and is therefore much sought after in a country where cows are held in such high esteem.

Newly appointed chief executive Stephen Wilson confirmed that the strategic direction of the company remains unchanged while his prior chief finance role will be assumed by Alison Henriksen who starts on 13 January.

SHARES SAYS: The business remains in rude health while the ASF opportunity seems undimished, stay invested.

‹ Previous2019-11-28Next ›

magazine

magazine