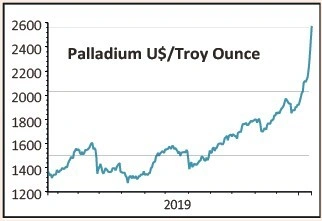

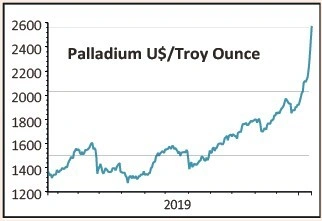

More expensive than gold, the price of a precious metal called palladium has rocketed in the past few months.

This week the metal topped $2,500 an ounce and is changing hands for double what it cost just seven months ago.

A critical component in catalytic converters, palladium demand is going up around the world as carmakers respond to government rules tackling pollution from petrol vehicles.

At the same time, supply from South Africa – one of the world’s biggest palladium producers – has dropped sharply as its mining industry suffered from the worst power outages in a decade due to heavy rain and flooding.

That’s led to a big supply deficit, set to hit 540,000 ounces in 2020 and 589,000 ounces in 2021 according to HSBC.

In a research note last year, Morgan Stanley said palladium prices could carry on rising until mid-2020 at least, with the market moving deeper into backwardation, a situation where futures trade below the spot price.

Examples of stocks and funds involved in palladium include FTSE 100 diversified miner Anglo American (AAL) and Sylvania Platinum (SLP:AIM) which focuses on platinum group metals platinum, palladium and rhodium.

Relevant exchange-traded funds include WisdomTree Physical Palladium (PHPD).

‹ Previous2020-01-23Next ›

magazine

magazine