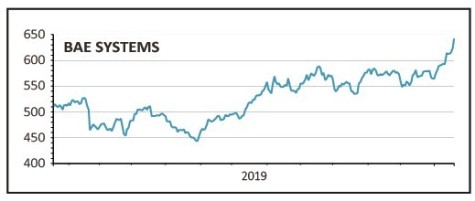

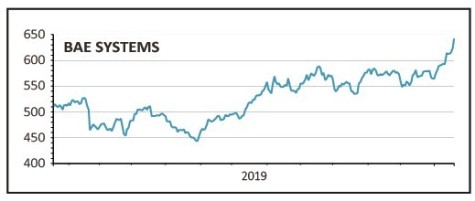

BAE Systems (BA.) 645p

Gain to date: 21.6%

Defence firm BAE Systems’ (BA.) $1.9bn acquisition of a military GPS system (Military Global Position System or MGP for short) from US firm Collins Aerospace (20 Jan) should help it locate significant new business across the Atlantic.

Coupled with the $275m purchase of Raytheon’s Airborne Tactical Radios division, it has also provided a further catalyst to the shares which are now up more than 20% since we said to buy a year ago.

Analysts at investment bank Berenberg comment: ‘This is clearly opportunistic M&A that is large but looks sensible from a strategic perspective as it would increase BAE’s capability in high-growth areas such as weapon systems and defence electronics.

‘MGP looks expensive but is high-margin – we guestimate c30% – and has compelling strong growth and high cash conversion. These deals will push BAE’s higher growth US activities towards 50% of group sales.’

The growth potential in the US was one of the key attractions we flagged when highlighting the opportunity at BAE and this deal-making has helped advance that expansion.

Less positively, the fate of a £10bn order for 48 Typhoon jets from Saudi Arabia remains in question and is one of the issues likely to be raised when the firm reports its full year numbers on 20 February.

SHARES SAYS: We remain positive on the stock.

‹ Previous2020-01-23Next ›

magazine

magazine