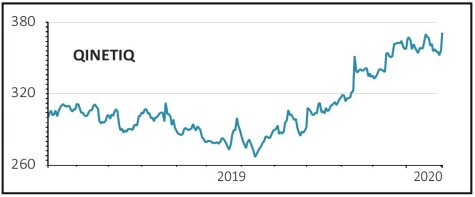

QinetiQ (QQ.) 372.4p

Gain to date: 9.2%

Shares’ positive view on QinetiQ (QQ.) was based upon its underappreciated transformation into an integrated global defence and security business with sustainable growth prospects.

The third quarter trading update on 4 February confirmed that the group is on track to deliver high single digit revenue growth and profit in line with expectations for the year to 31 March 2020.

US growth was boosted in January when the US Army announced its intention to award the Robotic Combat Vehicle Light program to QinetiQ. This demonstrated the strategic benefits of the recent MTEQ acquisition, a US based state-of-the-art sensing technology company.

The contract was awarded in part because of the ability of QinetiQ to leverage its sensing technology to provide a solution that ‘enables the US warfighter to overcome the next generation of threats, increase force projection, and reduce cognitive burden’.

Also in January the European Space Agency awarded the company a €75m contract to extend Europe’s capabilities in Earth observation.

SHARES SAYS: The momentum in overseas contract wins supports our case that the business is becoming far more dynamic than investors have given it credit. Keep buying.

‹ Previous2020-02-06Next ›

magazine

magazine