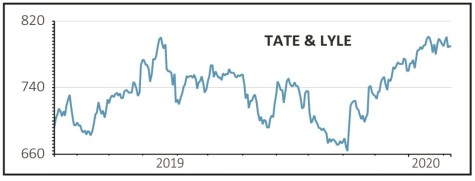

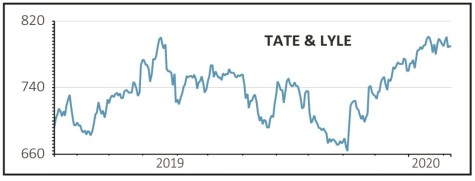

TATE & LYLE (TATE) 786.6p

Gain to date: 8.2%

Our bullish call on cash generative food producer Tate & Lyle (TATE) is a respectable 8.2% in the money, yet we are holding on for additional upside.

We see Tate & Lyle as well positioned to grow with large food and beverage customers.

It is also well aligned with current trends given its provision of plant-based ingredients and solutions to customers, enabling it to profit from the boom in demand for plant-based proteins.

As outlined in our original story, Tate & Lyle is a global provider of corn-based sweeteners and starch ingredients as well as sucralose zero-calorie sweetener that has transformed itself into a higher margin and more stable speciality ingredients supplier.

In its latest trading update (6 Feb), Tate & Lyle left guidance for the year to March 2020 unchanged, continuing to expect ‘broadly flat to low-single digit’ earnings per share growth. This followed a robust third quarter of operational progress in which Tate & Lyle’s underlying performance was ‘consistent’ with the first half, implying organic growth of around 5%.

SHARES SAYS: We’re staying sweet on Tate & Lyle for its global growth potential and an attractive 3.8% yield, based on Berenberg’s full year dividend per share estimate of 30.3p.

‹ Previous2020-02-13Next ›

magazine

magazine