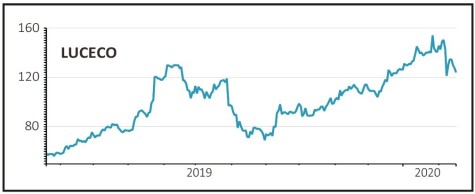

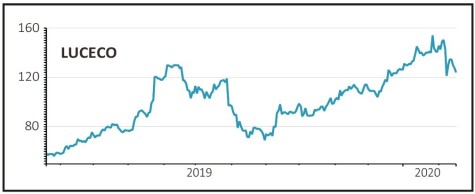

LUCECO (LUCE) 123.8p

Gain to date: 6.7%

Investors seem to be taking a shoot first, ask questions later approach to electronics components and LEDs firm Luceco (LUCE) and any potential output problems from the shutdown of its factory in Jiaxing, China.

The site has been closed down for the past couple of weeks because of the coronavirus outbreak. Importantly, there have been no reported cases of coronavirus among Luceco’s employees.

But after raising 2020 full year guidance at the end of January thanks to firming demand, investors are clearly concerned that those bumped up targets may now be missed.

As we went to press we had been unable to confirm if, or when, the factory might reopen but as analysts at Liberum rightly point out, ‘any shortfall in volumes near-term can be made up for during the rest of the year at the cost of some modest overtime’.

‘Management note that there is no impact to current full year guidance’, which was raised only a few weeks ago, for 2020 adjusted operating profit of between £20.5m and £21.5m, up from £19.4m previously.

SHARES SAYS: Short-term risks cannot be discounted but the powerful growth and margin improvement story remains intact. We will keep an eye on events in case of a more prolonged impact.

‹ Previous2020-02-20Next ›

magazine

magazine