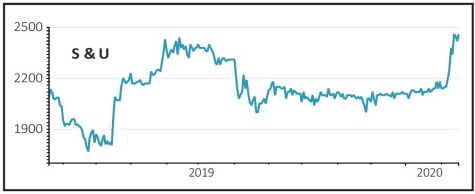

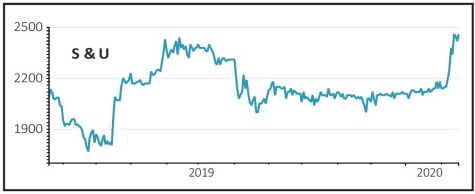

S & U (SUS) £24.40

Gain to date: 9.9%

Motor finance and bridging loan provider S & U (SUS) delivered another positive trading update last week, confirming our view that the business is well placed to cash in on a recovery in the UK economy.

The volume of transactions has increased in both businesses since the general election in December with the result that, unlike many of its rivals in the used-car market, S & U will meet earnings forecasts when it reports in March.

In contrast with the new car market, the used car market where Advantage operates saw steady volumes last year while prices rose by over 6%. As vehicle manufacturers cut production of diesel cars, demand for nearly-new eco-friendly diesels continues to rise, pushing up used prices.

Meanwhile the Aspen property bridging business is ‘making progress’ according to chairman Anthony Coombs. Demand for new loans, typically for residential developments, is starting to pick up while the level of repayments has also improved which has helped group cash flow.

Despite slower profit growth, in line with company forecasts, the board approved an increase in the second interim dividend in a sign of confidence in the outlook for both businesses.

SHARES SAYS: S & U is a great way to play a UK recovery and we remain buyers.

‹ Previous2020-02-20Next ›

magazine

magazine