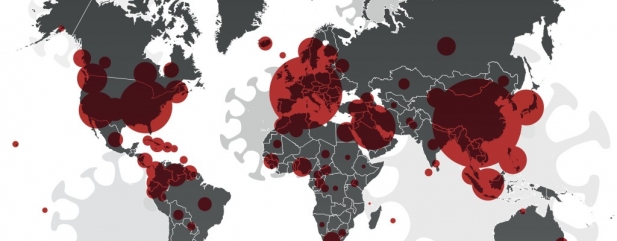

1. The Covid-19 coronavirus led the narrative in February, as a spike in new cases outside of China heightened global uncertainty. Expectations of weaker-than-expected global energy and metals demand growth (especially from China) also led commodity prices to decline in February. Although this will adversely impact net exporters such as Russia, net importers such as India stand to benefit, in our estimation. While first-quarter 2020 economic growth is expected to be severely impacted, we could see growth in the short-term continue to be affected as a resumption in Chinese production, and demand may not necessarily translate into a full recovery in exports.

2. South Korea saw a sharp rise in new cases of Covid-19 in February, taking its total (at that point) to the highest globally outside of China. In late February, the Bank of Korea disappointed investors by leaving its benchmark interest rate unchanged at 1.25%, choosing instead to undertake targeted support such as increasing the special lending facility for small companies that were impacted by the outbreak. High household debt levels and real estate inflation remained key concerns. We believe that there is significant pent-up demand, which could lead to a swift recovery once the virus has been contained.

3. Thailand was one of the weakest markets in February as Covid-19 and a rise in political uncertainty compounded impact from the country’s worst drought in 40 years, along with budget delays. In addition to new investment measures and tax benefits, the government announced plans to introduce an economic stimulus package covering tourism, consumption and investment in the near term. The Bank of Thailand also cut its benchmark interest rate to a record low of 1.0% in February amid efforts to stimulate the domestic economy.

‹ Previous2020-03-26Next ›

magazine

magazine