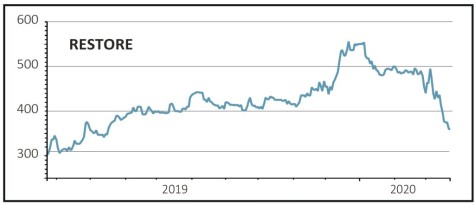

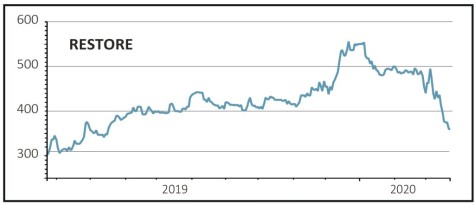

Restore (RST:AIM) 360p

Loss to date: 14.2%

The latest results from document management firm Restore (RST:AIM) show that the business continues to fire on all cylinders, gaining market share while at the same increasing profit.

Revenue for the year to 31 December was 10% higher, driven by a combination of high recurring revenues in lower-growth markets like records management and shredding, where increased regulation helps to drive sales, and above-market growth in faster-growing segments like digital scanning and IT recycling and relocation.

As well as generating steady organic growth thanks to top-tier positions in each of its businesses, the management team is always looking to increase market share and cross-selling opportunities through attractive bolt-on acquisitions.

Due to the fragmented nature of many of its markets, there is significant room to continue growing while at the same time a focus on technology and operating efficiency means that margins and earnings can expand faster than revenues. Profit last year was up 13%.

Chief executive Charles Bligh is wholly-focused on growing Restore’s cash generation, which together with the firm’s strong financial base ensures it is well-placed to ride out the current crisis and will be ‘the first out of the blocks’ when the economy normalises.

SHARES SAYS: We remain positive on the shares.

‹ Previous2020-03-26Next ›

magazine

magazine