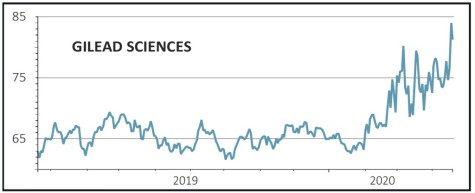

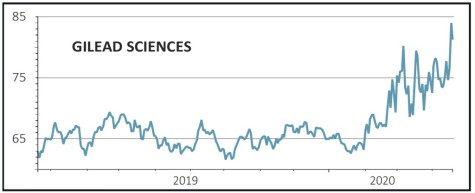

Shares in California-based biopharmaceutical firm Gilead Sciences jumped 15% in after-hours trading on 16 April after an industry healthcare magazine reported rapid recoveries in fever and respiratory systems in coronavirus patients given remdesivir in a study being conducted at the University of Chicago Medicine.

The news from the leaked report lifted stock markets around the world as investors became more hopeful about a solution to the pandemic.

There have been high hopes for remdesivir, originally developed to treat Ebola, but never approved. The excitement relates to a 2017 paper showing it was effective against other diseases and improved the respiratory function in mice.

Excitement may be running high, judging by the sharp move in Gilead’s share price and markets rallying on the day, but there are a couple of good reasons why cooler heads should prevail.

Official data from the two trials being run by Gilead are not expected to be released until later this month or early May. In one trial 600 patients with mild symptoms are taking the drug while in the other 400 patients with severe symptoms are being tested. The drug is also being tested across larger patient groups in over 150 sites around the world.

The other reason to temper enthusiasm comes from the University of Chicago itself, which commented: ‘Drawing any conclusions at this point is premature and scientifically unsound.’

This refers to the fact that the trial is not being conducted as a so-called ‘randomized, double blind study’ which ensures results are free from bias. A double blind study means that neither the experimenters nor the patients know who has received the drug or the placebo and the results are considered more statistically reliable.

That said if the early anecdotal evidence is backed-up by more rigorous study data, there is a genuine case to make for the drug playing an important role in treating patients with coronavirus.

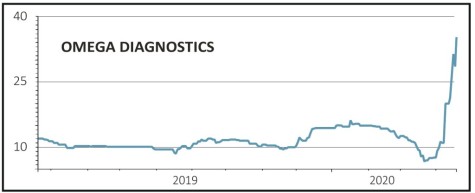

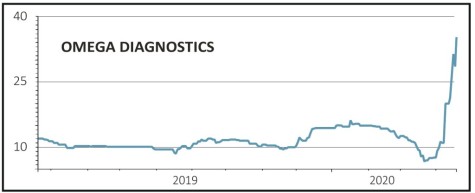

In related news, on 20 April shares in UK diagnostics firm Omega Diagnostics (ODX:AIM) jumped by 20% after it signed an agreement with its peer Mologic to manufacture its laboratory-based coronavirus test-kit.

Once validated, Omega and Mologic will enter into a longer-term supply agreement with Omega manufacturing up to 46,000 COVID-19 tests per day.

This is in addition to the announcement made by the Omega on 9 April 2020 relating to the creation of a consortium to jointly develop and manufacture a point-of-care COVID-19 lateral flow antibody test which could be used at home.

‹ Previous2020-04-23Next ›

magazine

magazine