The pressure on dividends from UK stocks continues to build amid the coronavirus crisis – at our last count 274 London-listed companies have cut, deferred or cancelled payouts totalling some £20.5bn.

This includes 34 FTSE 100 firms. On the other side of the ledger, 82 firms have retained £4.4bn worth of dividends encompassing eight constituents of the FTSE 100.

Plumbing products firm Ferguson (FERG), Primark-owner Associated British Foods (ABF), events and media firm Informa (INF) and packaging business Smurfit Kappa (SKG) are some of the most recent FTSE 100 firms whose dividends have been casualties of the current economic stress.

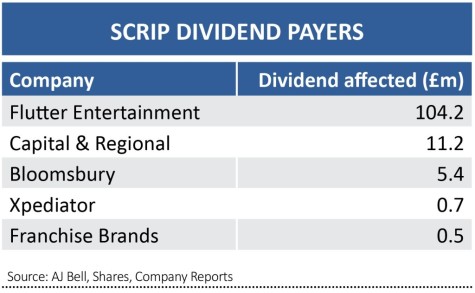

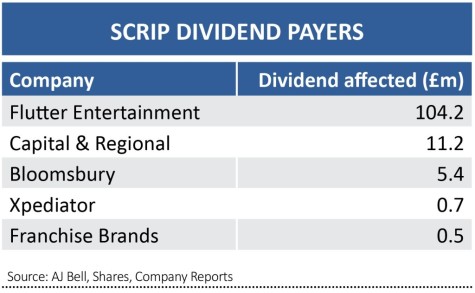

A handful of firms have gone down a different route to conserve cash. Towards the end of April small cap freight management services firm Xpediator (XPD:AIM) and book publisher Bloomsbury (BMY) became the latest companies to announce plans to pay a scrip dividend to shareholders.

A scrip dividend effectively means issuing dividends in (typically) new shares rather than cash.

The largest firm to use the scrip option this year is bookmaker Flutter Entertainment (FLTR) which announced on 27 March that it would pay its 2019 full year dividend in shares.

Although paying dividends as new shares reduces pressure on the balance sheet, by increasing the number of shares in issue it is also dilutive to shareholders.

Both Royal Dutch Shell (RDSB) and BP (BP.) have offered the option of taking a scrip dividend in recent years after an oil price crash meant they couldn’t fund their dividends from cash flow.

Shell’s subsequent move of buying back shares (now abandoned) was an admission that the scrip programme wasn’t pain-free for shareholders give the dilution involved.

Some platforms, including AJ Bell Youinvest, do not allow you to elect to take dividends in shares if there is a choice between cash and stock, but if the scrip is not optional you should be able to receive the relevant shares, which are liable for income tax in the same way as a dividend.

Companies continue to raise cash

In addition to holding on to cash by putting dividends on hold, many firms are going cap in hand to investors to raise money to bolster their balance sheet to see them through the current uncertainty.

More than 80 firms have raised a total of £3.9bn in new capital, although only two of these are FTSE 100 firms, being Informa and cruise operator Carnival (CCL).

‹ Previous2020-04-23Next ›

magazine

magazine