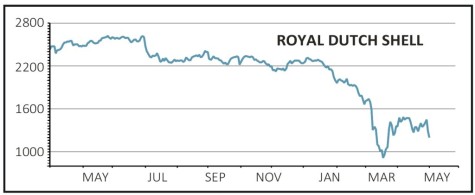

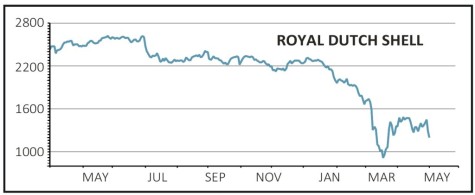

Royal Dutch Shell (RDSB) £12.72

Loss to date: 5.5%

We were surprised to see Royal Dutch Shell (RDSB) cut its dividend by two thirds given its strong track record paying out during good and bad times. However the move could help the business in the longer term.

While disappointment over the loss of income is natural, having ripped off the band aid with this drastic action on the dividend Shell can now move forward on a more sustainable footing. Its peer BP (BP.) may be left wishing it had done the same when it had the opportunity a couple of

days before.

Shell should be able to stay within a 20% to 30% gearing range (ratio of debt to equity), yet BP has admitted it will be above this level for the remainder of 2020 at least.

Richard Buxton, head of UK equities at Merian Global, says Shell’s new yield, at around 4%, still compares favourably to base rates and bonds.

‘I’m more interested in adding to a holding in Shell now than when it was yielding more than 10%, a level in my view which was clearly unsustainable,’ he adds.

The downside is a degree of uncertainty over what the company does next. Will it use the greater financial flexibility it enjoys without the burden of such a generous dividend to invest more heavily in renewables projects?

RBC Capital Markets thinks this could be the case. It comments: ‘The move will allow Shell to pivot more easily through the energy transition and not be tied to a $15bn dividend to service each year.’

This could be a long-term positive but there are questions over whether such a line of business will be as profitable as its traditional oil and gas operations.

In the shorter term though Shell should still be a good way of playing a recovery in oil. In our view an eventual rebound from these levels is likely.

Investment bank JP Morgan Cazenove comments: ‘Market feedback points to generalists’ “FOMO” (fear of missing out) in the sector which could trump the dividend cut as a buyers’ market emerges at $20 oil.’

SHARES SAYS: Shell has renewed flexibility and although the dividend cut is painful the stock remains a good

way to play an oil recovery. Keep buying.

‹ Previous2020-05-07Next ›

magazine

magazine