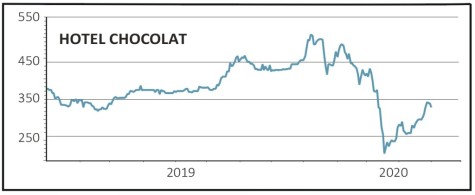

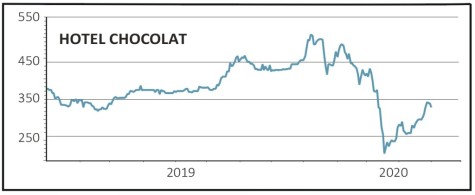

HOTEL CHOCOLAT (HTOC:AIM) 322.5p

Loss to date: 23.8%

COVID-19 and the lockdown have created challenges for premium British chocolatier Hotel Chocolat (HOTC:AIM), one of our ‘10 winning stocks for 2020’ picks. Our bullish call is 23.8% in the red and dividends are off the menu for now, but we remain positive on the long-term potential of the brand and its scope for domestic and overseas growth, principally in the US and Japan.

In its latest update (4 May), the posh chocolates brand announced it had increased its banking facilities to help see it through the coronavirus crisis, building on an oversubscribed £22m placing in March to fund growth investment and provide operational headroom.

Hotel Chocolat conceded the closure of retail stores had a material impact on trading during the crucial Easter period. Thankfully, ravenous online appetite for the brand helped to cushion the impact, as consumers treated themselves via the internet to its affordable luxuries during lockdown.

Every day at Easter, the online demand exceeded the quantity of orders Hotel Chocolat could accept due to safe working requirements, while wholesale partners Amazon and John Lewis also saw strong trading as the coronavirus outbreak accelerated the online channel shift.

SHARES SAYS: We remain fans of well-capitalised Hotel Chocolat, whose market leadership in digital and subscription chocolate is now more valuable than ever, as reflected in a recent rally in the share price.

‹ Previous2020-05-07Next ›

magazine

magazine