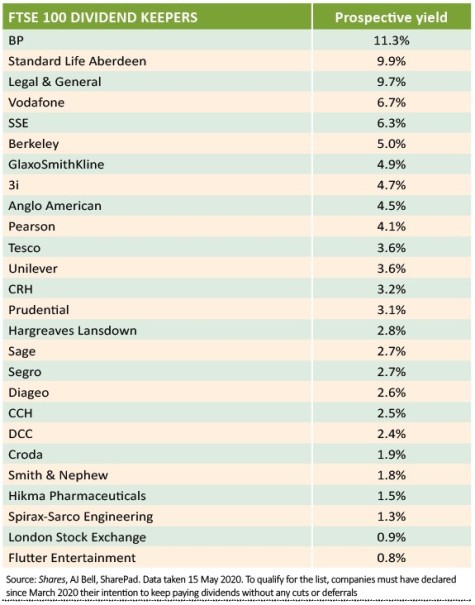

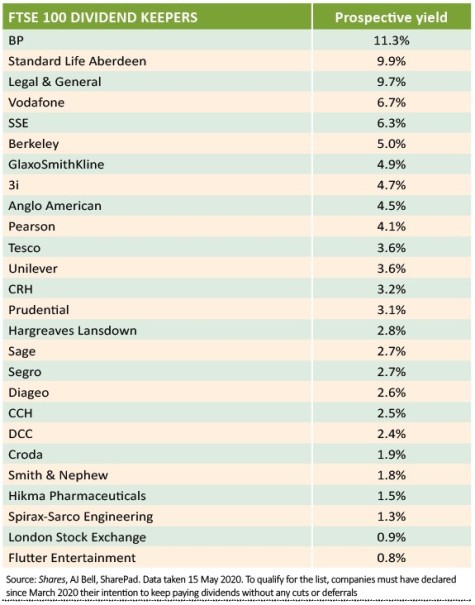

Since the middle of March almost half of the companies in the FTSE 100 have suspended or cut altogether their final 2019 and full year 2020 dividends.

So far just 26 companies in the FTSE have not changed their plans to pay dividends. The names are published in this article alongside all the relevant stocks outside of the FTSE 100.

We have included the prospective yields based on the latest share price and the amount of dividends a company is forecast to pay for the next full year period it reports.

Some of the highest yields and biggest cash payouts are at oil giant BP (BP.), which is yielding over 11%, mobile operator Vodafone (VOD) which yields 6.7%, and insurer Legal & General (LGEN) which yields 9.7%.

BP committed itself to paying out £1.7bn just a week before Royal Dutch Shell (RDSB) cut its dividend, which begs the question if the timing had been different, would it also have cut its payout?

It is debatable whether Legal & General will press ahead with its payout, given pressure from the European insurance and pension regulator and the decision by rivals Aviva (AV.) and RSA (RSA) to suspend their dividends.

That said, Phoenix (PHNX) is still paying dividends, as is Hastings (HSTG) albeit at a lower rate. Direct Line (DLG) will make a decision on 2020 dividends when it releases its first half results on 4 August.

Outside of the FTSE 100, financial companies look more reliable when it comes to dividends as many of them will have benefited from increased trading activity, such as CMC Markets (CMCX) and

IG Group (IGG).

‹ Previous2020-05-21Next ›

magazine

magazine