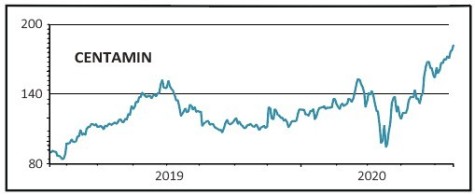

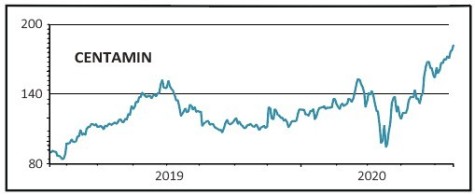

Centamin (CEY) 180p

Gain to date: 38.9%

Since hitting a low when gold prices bottomed out on 18 March, shares in FTSE 250 miner Centamin (CEY) have bounced back and then some.

In two months, the Egypt-based gold miner has seen its share price shoot up 91% from around 94p to 180p this week.

The miner’s rise has been helped by a 17% hike in the price of gold to $1,735 per ounce, as well as strong financial results for 2019 and the fact it’s been largely unaffected by the coronavirus crisis.

Its delayed 2019 results showed a 13% jump in profit after tax to $172.9m and a 7% rise in revenue to $658.1m, while its first quarter update for 2020 showed operations progressing smoothly.

Operational problems have been a big issue for Centamin in the past given it only has one (albeit world class) producing asset, the Sukari gold deposit near Egypt’s Red Sea.

First quarter production of 125,000 ounces of gold at an all-in sustaining cost (AISC) of $902 per ounce sold was within annual guidance, and should translate into hefty profits given the current gold price. The firm also continues to pay dividends.

SHARES SAYS: A wave of monetary and fiscal stimulus should support gold prices further and Centamin is well placed to benefit. Keep buying.

‹ Previous2020-05-21Next ›

magazine

magazine