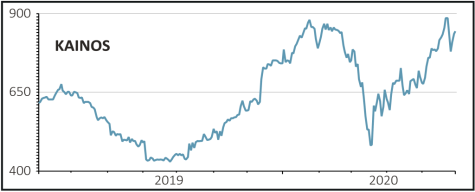

KAINOS (KNOS) 850p

Gain to date: 18.4%

Original entry point: Buy at 718p, 19 December 2019

It didn’t take long for the market to cotton on to the opportunity that lies ahead for Kainos (KNOS), one of our top picks for 2020.

Since our last update on 30 April the share price has surged more than 25%, putting the investment back in positive territory.

The Belfast-based digital services and platform company reported revenues and earnings before interest, tax, depreciation and amortisation (EBITDA) of £178.8m and £28.4m respectively for the year to 31 March 2020, beating market expectations which had been pitched at £171.5m and £27.4m.

Sceptics will point out that the period under review felt little impact from the Covid-19 outbreak. While that may largely be true it is worth noting company commentary that points to largely maintained spending globally on IT projects, although its previous rapid growth from its enterprise Workday practice will be harder to protect than more secure public sector investment.

This has included springing into action to streamline some central government and NHS processes and to allow both to function amid lockdown.

SHARES SAYS: Inherent uncertainty remains during the pandemic but we continue to see Kainos as a strong long-term beneficiary of working from home and other digital implementations.

‹ Previous2020-06-04Next ›

magazine

magazine