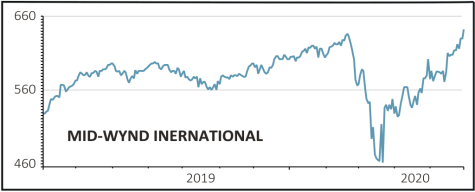

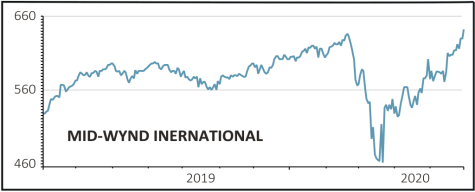

Mid-Wynd International (MWY) 650p

Gain to date: 12.3%

Original entry point: Buy at 578.94p, 5 March 2020

Shares in investment trust Mid-Wynd International (MWY) have hit a new record high of 650p, meaning the stock is already up 12.3% since we said to buy three months ago.

Mid-Wynd regularly buys and sells stocks, particularly locking in gains when valuations look excessive.

It avoided a lot pain during this year’s lockdown by having offloaded its holdings in the tourism sector last summer, a part of the stock market which was heavily sold down as the coronavirus crisis spread globally. ‘The timing was fortuitous,’ says fund manager Simon Edelsten.

Mid-Wynd didn’t sell out of this sector because it expected a pandemic, but rather because the environmental arguments against significant tourism growth were getting a much bigger airing.

‘Through focusing on long-term trends as opposed to short-term events, the managers have been able to identify high-quality companies which can continue to generate revenue irrespective of the macroeconomic uncertainty,’ says William Sobczak, an analyst at research group Kepler.

‘This has been proven in 2020 with a number of sectors, including healthcare, automation and scientific equipment performing extremely strongly.’

SHARES SAYS: Often overlooked because of its relatively small size (£319m market cap), however its strong performance speaks for itself. An intention to

sustain progressive dividends adds to its merits.

‹ Previous2020-06-04Next ›

magazine

magazine