New rules requiring passengers to quarantine for 14 days upon arrival in the UK could deal a hammer blow to demand for travel firms in the midst of their crucial summer trading period.

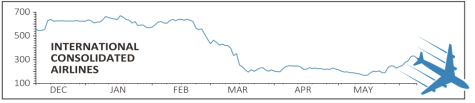

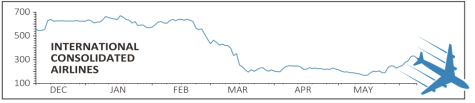

The country’s three biggest airline firms – Ryanair (RYA), EasyJet (EZJ) and British Airways owner International Consolidated Airlines (IAG) – have come together to launch a legal challenge against the rules, which threaten to derail their plans to ramp up capacity for the summer period if the matching demand isn’t there.

The three firms have sent a pre-action protocol letter, calling the 14-day quarantine rule illogical and unfair, arguing it has been brought in too late and could kill off any nascent recovery in the aviation sector this summer.

Ryanair has been especially vocal against the plans, and chief executive Michael O’Leary revealed the quarantine doesn’t seem to be putting off UK passengers with outbound bookings to Mediterranean having doubled compared to last week before the rules were in place. Inbound bookings are down however.

The legal action against the quarantine has been spearheaded by IAG, which has also been in the spotlight over the past week having been accused of ‘exploiting’ the coronavirus pandemic to cut staff costs.

The group, which also owns Irish carrier Aer Lingus and Spanish airlines Iberia and Vueling, plans to fire all 42,000 staff and rehire a majority of those not made redundant on worse terms, something it says is essential for the future of the business.

Union Unite says the plans could make British Airways cabin crew the worst paid of all UK airlines.

In a letter to staff last week, British Airways chief executive Alex Cruz said the airline does not have an ‘absolute right to exist’, with ‘major competitors ready and poised to take our business’. He also revealed IAG has an operating cash burn of £178m a week.

The move has not harmed the company’s share price, which is up around 20% since the start of June, with markets tending to view job cuts and renegotiations most of the time as prudent cost saving measures.

However, IAG’s plans appear not to have gone down well with the public and also risk the firm performing poorly from an environmental, social and governance (ESG) point of view, in particular on the ‘S’ part of ESG.

According to S&P Global, social factors can affect how consumers judge a company’s behaviour, with things like labour issues – something which has consistently affected IAG – potentially affecting a firm’s profitability by creating a scarcity of skilled employees or controversy that is damaging to a company’s reputation.

‹ Previous2020-06-11Next ›

magazine

magazine